DR. REDDY’S MUST BE MORE CAREFUL IN ITS FUTURE ACQUISITIONS ABROAD

The German connection (read, its acquisition of Betapharm) has certain

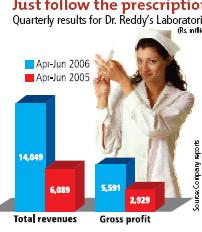

ly brought pleasant tidings for Dr. Reddy’s Laboratories in the April-June quarter. The company reported a massive revenue surge (year on year) of about 151%, which stood at Rs.14 billion as against Rs.5.6 billion in the corresponding quarter of 2005. The company savoured a 320% surge in net profits (consolidated), which were pegged at Rs.1.29 billion. As predicted, Dr. Reddy’s benefited from the Betapharm acquisition, which contributed close to Rs.2 billion in revenues to the coffers. On the other hand, generic drugs, Finastride and Simvastatin, (which are enjoying their 180 day exclusivity period) contributed Rs.3.35 billion in revenues. G.V. Prasad, Vice-Chairman & CEO of Dr. Reddy’s stated, “I would like to emphasise that Dr. Reddy’s has also had a good organic performance.” Things haven’t been as rosy, though, in the Betapharm acquisition. The primary cause has been the German government’s decision to decrease the prices of generic firms by about 30% with effect from June 1, 2006.

ly brought pleasant tidings for Dr. Reddy’s Laboratories in the April-June quarter. The company reported a massive revenue surge (year on year) of about 151%, which stood at Rs.14 billion as against Rs.5.6 billion in the corresponding quarter of 2005. The company savoured a 320% surge in net profits (consolidated), which were pegged at Rs.1.29 billion. As predicted, Dr. Reddy’s benefited from the Betapharm acquisition, which contributed close to Rs.2 billion in revenues to the coffers. On the other hand, generic drugs, Finastride and Simvastatin, (which are enjoying their 180 day exclusivity period) contributed Rs.3.35 billion in revenues. G.V. Prasad, Vice-Chairman & CEO of Dr. Reddy’s stated, “I would like to emphasise that Dr. Reddy’s has also had a good organic performance.” Things haven’t been as rosy, though, in the Betapharm acquisition. The primary cause has been the German government’s decision to decrease the prices of generic firms by about 30% with effect from June 1, 2006.For Complete IIPM - Article, Click on IIPM-Editorial Link

Source:- IIPM-Business and Economy, Editor:- Prof. Arindam Chaudhuri - 2006

No comments:

Post a Comment